Is Whole Farm Revenue Protection Right for You?

Is Whole Farm Revenue Protection right for you? We asked and young farmers answered. There aren’t many crop insurance programs that truly meet the needs of many of the young farmers in our network. In fact, only 5% of young farm owners who responded to our 2017 survey reported using the Risk Management Agency’s (RMA) […]

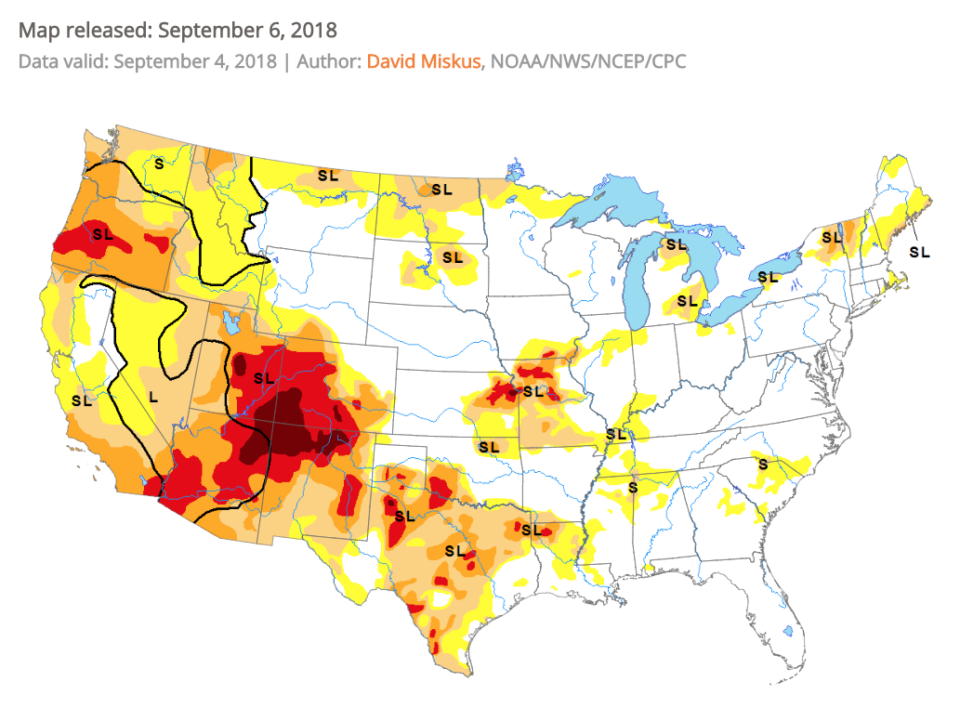

Drought, wildfire, hail: is there a USDA Disaster Assistance Program to help your farm or ranch?

Every year, natural events, from drought and wildfires to hurricanes and hail, impact the businesses of farmers and ranchers across the country. Currently, the Four Corners region of the U.S. is experiencing exceptional drought (the worst category!) and most of the Southwest is experiencing some level of drought or dry conditions. In addition to […]

One young farmer is thankful for crop insurance, could it be right for you?

Case Study: Topp Fruits, Paonia, Colorado The western slope of Colorado is known for its peaches, so when Harrison Topp returned to the Rockies after years of farming vegetables in North Carolina, it’s no surprise that he was happy to start restoring 15 acres of older stone fruit trees on his family’s land in Paonia, […]

Talking Crop Insurance and Commodities with Ferd Hoefner: Farm Bill Politics 3

Ferd Hoefner, the senior strategic advisor to the National Sustainable Agriculture Coalition, schools us on how crop insurance and commodity programs work and why they’re causing problems. This podcast is critical listening for anyone looking to understand the farm bill. Lindsey Lusher Shute interviews; Andrew Bahrenburg walks and records; Hannah Beal edits; music Lee Rosevere.

Is Whole Farm Revenue Insurance right for your farm?

Whole Farm Revenue Protection (WFRP) is a new national crop insurance program for farmers. Since it is so new, lots of people are unclear about how it works. Traditionally, CSA and market farmers didn’t buy crop insurance because the crops they grew weren’t covered, the paperwork was mountainous, or the coverage amounts were based on […]

Land Stewardship Program Releases New Report – "Crop Insurance – How a Safety Net Became a Farm Policy Disaster."

Although we don’t often discuss it, one of the largest ways that the government and US farming community interact are through crop insurance. NYFC focuses on highlighting and reforming the many programs and institutions that play a big role in beginning farmers’ lives, and for most – in particular for first-generation farmers – crop insurance […]

USDA Risk Management Agency Awards $13.6 Million in Grants to Promote Crop Insurance Education

On October 28, 2011, the U.S. Department of Agriculture announced that its Risk Management Agency (RMA) awarded grants to 125 organizations that will engage in crop insurance education and outreach. The grants totaled 13.6 million dollars and were distributed to organizations in 47 states. They came from two separate programs: the “Education and Outreach” program […]

AGR-Lite: Is It the Right Choice for Your Farm?

On Wednesday, September 28, the National Center for Appropriate Technology (NCAT) hosted a webinar about a new federally-subsidized insurance program called Adjusted Gross Revenue Lite (AGR-Lite). According to the presentations, AGR-Lite can provide either revenue insurance, which can protect farmers from declines in crop prices or yields, or multi-peril insurance, which can protect against low […]